Straightforward Retirement Education

Retirement Risk Management Explained

A retirement plan is not complete without looking at how to protect it. Insurance, healthcare, and risk management can influence long term financial stability, especially when unexpected events occur. Understanding the types of risks people encounter and the tools...

Retirement Savings and Growing Them Over Time

This step provides a general overview of how retirement accounts work, how investments are structured, and how people often think about long term savings. Understanding these building blocks helps you make informed decisions about how to support the lifestyle you want...

Understand your Retirement Income Sources

Retirement income usually comes from multiple places, not just savings or a single benefit program. Understanding these sources can help you see how each one contributes to your overall financial picture. Four Common Income Sources Most retirees receive income from a...

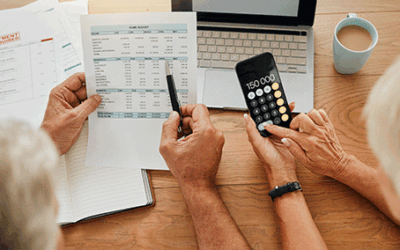

How to Create a Financial Inventory Before Planning for Retirement

Before planning forward, it’s helpful to understand where you stand today. Many people have a general idea of their finances but haven’t assembled everything in one place. Creating a clear inventory provides a sense of control and becomes the foundation for future...

Define Your Retirement Goals: Start With Your Vision, Not the Numbers

Retirement planning often begins with numbers, but clarity starts with your vision. Your goals influence your income needs, those needs shape your savings targets, and those targets inform how you invest. Beginning with your life, not the spreadsheets, helps make the...

Retirement Resources

If you don't know where to start, our retirement education resources introduce you to general concepts you'll need in order to understand how benefit programs and savings options work together. If you want additional information, we can refer you to our network of independent experts.

Income & Benefits Education

You'll learn about the general concepts and retirement rules that will help you understand how different retirement programs and saving options may affect your long term financial stability. If you want additional information, we can refer you to our network of independent experts.

Discover Retirement Basics

Retirement benefits can feel overwhelming. Our articles and guides break it down for you so you can thoroughly understand the factors that are important to your situation. Use our resources at your own pace. Explore our materials and build your knowledge about how all these retirement elements fit together.